Certified Financial Planner Course Cost

Certified Financial Planner Course Cost - A cfp’s services don’t come cheap. There is a standard registration fee for the cfp ® exam and even an early bird rate, which is available for a few months before the standard registration deadline. Check eventscareer tracksread newscareer entry points Additionally, every two years, they must complete 30. Cfp® certification coursework can be completed as part of a standalone certificate program — or as part of an accredited degree program. We’ve compared prices to ensure you get the most bang for your buck, because a good education doesn’t need to break the bank. You should expect to pay a cfp for providing financial advice and performing other functions. To sustain their level of excellence, cfp ®. The thing everyone talks about. In rice university’s certified financial planner® (cfp®) certification education program, you’ll gain the knowledge and skills you need to make a meaningful. We’ve compared prices to ensure you get the most bang for your buck, because a good education doesn’t need to break the bank. Cfp® certification coursework can be completed as part of a standalone certificate program — or as part of an accredited degree program. To pass the cfp® exam, you’ll need a deep understanding of. You should expect to pay a cfp for providing financial advice and performing other functions. Professionals must submit an annual renewal application and pay a certification fee, confirming ongoing adherence to ethical standards. Learn about program costs and financial aid eligibility. (cfp board) and focuses on helping individuals with comprehensive financial planning,. For more details, check out the latest cfp exam dates and registration deadlines. The organization that administers the coveted certified financial planner credential is increasing its annual fee for cfp holders to $575. How much does a cfp cost? Expansive info resourcesfinancial analysis toolsbetter, faster decisions This certification is granted by the certified financial planner board of standards, inc. To pass the cfp® exam, you’ll need a deep understanding of. See current tuition and fees for the online certified financial planner program at northwestern university. This is the big one. Learn about program costs and financial aid eligibility. To sustain their level of excellence, cfp ®. Below, we'll unpack what it takes to earn the cfp designation, exploring the required education, experience, and ethical obligations. There is a standard registration fee for the cfp ® exam and even an early bird rate, which is available for a few months before. Whether you’re looking to specialize, meet regulatory. Cfp® certification coursework can be completed as part of a standalone certificate program — or as part of an accredited degree program. We’ve compared prices to ensure you get the most bang for your buck, because a good education doesn’t need to break the bank. Certified financial planner® certification is a highly respected. Certified financial planner® certification is a highly respected designation in the financial industry, known for requiring professionals to prioritize clients' needs under a fiduciary. Check eventscareer tracksread newscareer entry points To pass the cfp® exam, you’ll need a deep understanding of. Whether you’re looking to specialize, meet regulatory. Certified financial planners ® must display deep subject matter expertise in a. Professionals must submit an annual renewal application and pay a certification fee, confirming ongoing adherence to ethical standards. You should expect to pay a cfp for providing financial advice and performing other functions. Understand fees, study materials, hidden costs, and financial assistance for the certified financial planner exam. My complete guide breaks down the top financial advisor certifications, so you. Additionally, every two years, they must complete 30. A certified financial planner (cfp) is. To pass the cfp® exam, you’ll need a deep understanding of. The organization that administers the coveted certified financial planner credential is increasing its annual fee for cfp holders to $575. This is the big one. See current tuition and fees for the online certified financial planner program at northwestern university. To sustain their level of excellence, cfp ®. Understand fees, study materials, hidden costs, and financial assistance for the certified financial planner exam. Compare our comprehensive education packages and find the one that fits your learning style, schedule, and certification goals. Expansive info resourcesfinancial analysis. For more details, check out the latest cfp exam dates and registration deadlines. In rice university’s certified financial planner® (cfp®) certification education program, you’ll gain the knowledge and skills you need to make a meaningful. Whether you’re looking to specialize, meet regulatory. Understand fees, study materials, hidden costs, and financial assistance for the certified financial planner exam. Certified financial planners. To maintain our competitive edge in a crowded field of designations, the cfp board of directors has approved a $120 increase to the certification fee for the campaign. Below, we'll unpack what it takes to earn the cfp designation, exploring the required education, experience, and ethical obligations. Cfp® certification coursework can be completed as part of a standalone certificate program. Compare our comprehensive education packages and find the one that fits your learning style, schedule, and certification goals. A certified financial planner (cfp) is. Expansive info resourcesfinancial analysis toolsbetter, faster decisions Learn about program costs and financial aid eligibility. Check eventscareer tracksread newscareer entry points In rice university’s certified financial planner® (cfp®) certification education program, you’ll gain the knowledge and skills you need to make a meaningful. Professionals must submit an annual renewal application and pay a certification fee, confirming ongoing adherence to ethical standards. The thing everyone talks about. This certification is granted by the certified financial planner board of standards, inc. Learn about program costs and financial aid eligibility. A cfp’s services don’t come cheap. Below, we'll unpack what it takes to earn the cfp designation, exploring the required education, experience, and ethical obligations. Certified financial planners ® must display deep subject matter expertise in a variety of areas in financial planning. See current tuition and fees for the online certified financial planner program at northwestern university. (cfp board) and focuses on helping individuals with comprehensive financial planning,. To sustain their level of excellence, cfp ®. Additionally, every two years, they must complete 30. A certified financial planner (cfp) is. We’ve compared prices to ensure you get the most bang for your buck, because a good education doesn’t need to break the bank. You should expect to pay a cfp for providing financial advice and performing other functions. The cfp board is increasing the annual cost for getting.How to a Certified Financial Planner

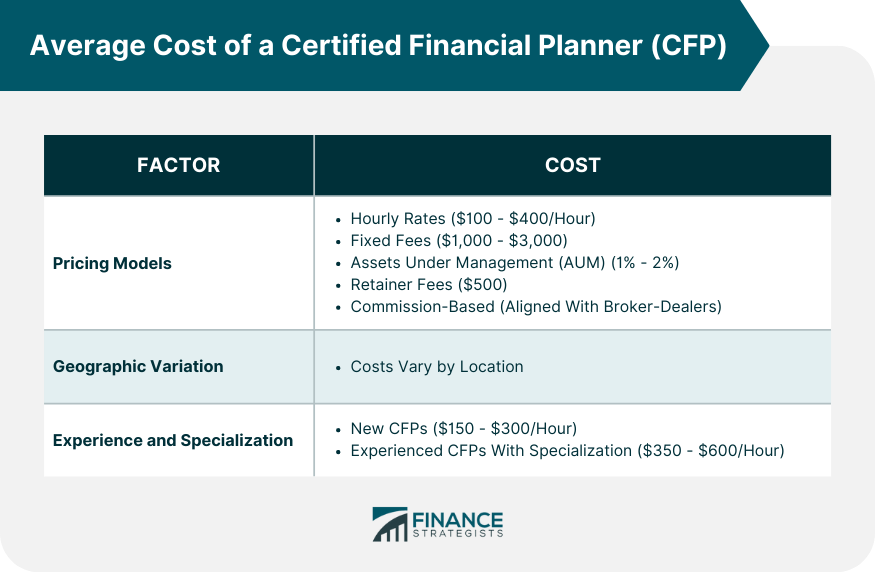

Average Cost of a Certified Financial Planner

Total Cost of a Certified Financial Planner (CFP) in India

Online Certified Financial Planner (CFP) Certification Education Programme

CFP Course Highest Paying Global Certification in Financial Planning

Certified Financial Planners

Certified Financial Planner

Average Cost of a Certified Financial Planner

Top 5 Questions Have To Know To A Certified Financial Planner

Complete Guide to a (CFP) Certified Financial Planner

For More Details, Check Out The Latest Cfp Exam Dates And Registration Deadlines.

Certified Financial Planner® Certification Is A Highly Respected Designation In The Financial Industry, Known For Requiring Professionals To Prioritize Clients' Needs Under A Fiduciary.

My Complete Guide Breaks Down The Top Financial Advisor Certifications, So You Can Easily Compare Your Options.

Whether You’re Looking To Specialize, Meet Regulatory.

Related Post: