Commodities Trading Course

Commodities Trading Course - Produced after hours of research and planning We will demonstrate common commodity trading strategies such as. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales and trading, or other areas of finance with the fundamental knowledge of fixed income. Such funds pool in investors’ money to make huge capital investments. The ncdex provides enhanced market transparency and empowers farmers to make better business decisions. The open outcry method stands in stark contrast to the electronic, online trading methods used by modern exchanges. Lastly, spread trading in commodities allows sophisticated investors to take advantage of mispricing opportunities for near riskless profits so understanding them is essential to a. It is designed to equip anyone who desires to begin a career in investment banking, sales, trading, treasury, or other areas of finance that require an. About cfi’s complete guide to trading the following ebook’s purpose is to outline all the necessary fundament skills needed to understand the capital markets in a trading context. One can invest in mutual funds or exchange traded funds (etfs) that focus primarily on companies involved in commodity production, processing, or distribution. This course provides a comprehensive overview of commodities. Produced after hours of research and planning You will have the opportunity to work through practice examples and learn how to identify key information on refinitiv workspace. We will introduce the key features of commodities and go over the major commodity categories with their key drivers. The ncdex provides enhanced market transparency and empowers farmers to make better business decisions. Then we will explore how commodities are traded in the derivatives markets using futures and options. About cfi’s complete guide to trading the following ebook’s purpose is to outline all the necessary fundament skills needed to understand the capital markets in a trading context. It is designed to equip anyone who desires to begin a career in investment banking, sales, trading, treasury, or other areas of finance that require an. Unlike stock trading or investing in mutual funds or etfs, commodity trading offers tremendous. This introductory commodities course is perfect for students interested in commodities derivatives and trading strategies. This course provides an overview of different futures and forward contracts, how they are priced, and various trading strategies such as hedging, speculating, and arbitrage. It is designed to equip anyone who desires to begin a career in investment banking, sales, trading, treasury, or other areas of finance that require an. You will have the opportunity to work through practice. Trading commodities is different from trading stocks. It is designed to equip anyone who desires to begin a career in investment banking, sales, trading, treasury, or other areas of finance that require an. It’s a different game, but a game worth learning for investors. Such funds pool in investors’ money to make huge capital investments. Lastly, spread trading in commodities. Open outcry trading takes place as follows: Every investment instrument is unique in terms of how best to generate profits from trading it. We will introduce the key features of commodities and go over the major commodity categories with their key drivers. It’s a different game, but a game worth learning for investors. About cfi’s complete guide to trading the. We will introduce the key features of commodities and go over the major commodity categories with their key drivers. This course provides an overview of different futures and forward contracts, how they are priced, and various trading strategies such as hedging, speculating, and arbitrage. Produced after hours of research and planning Such funds pool in investors’ money to make huge. Then we will explore how commodities are traded in the derivatives markets using futures and options. Unlike stock trading or investing in mutual funds or etfs, commodity trading offers tremendous. This fixed income fundamentals course is perfect for anyone who wants to build up their understanding of capital markets. This introductory commodities course is perfect for students interested in commodities. This introductory commodities course is perfect for students interested in commodities derivatives and trading strategies. You will have the opportunity to work through practice examples and learn how to identify key information on refinitiv workspace. The open outcry method stands in stark contrast to the electronic, online trading methods used by modern exchanges. Open outcry trading takes place as follows:. Open outcry trading takes place as follows: Such funds pool in investors’ money to make huge capital investments. Produced after hours of research and planning Every investment instrument is unique in terms of how best to generate profits from trading it. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales and. Commodities trading also allows for market participants to invest and speculate on commodity prices, while providing diversification beyond traditional securities. We will introduce the key features of commodities and go over the major commodity categories with their key drivers. Unlike stock trading or investing in mutual funds or etfs, commodity trading offers tremendous. Produced after hours of research and planning. About cfi’s complete guide to trading the following ebook’s purpose is to outline all the necessary fundament skills needed to understand the capital markets in a trading context. Open outcry trading takes place as follows: Under the open outcry method, traders communicate trading. There are several indirect ways to invest in hard vs soft commodities. Trading commodities is different from. We will introduce the key features of commodities and go over the major commodity categories with their key drivers. One can invest in mutual funds or exchange traded funds (etfs) that focus primarily on companies involved in commodity production, processing, or distribution. This fixed income fundamentals course is perfect for anyone who wants to build up their understanding of capital. One can invest in mutual funds or exchange traded funds (etfs) that focus primarily on companies involved in commodity production, processing, or distribution. This course provides an overview of different futures and forward contracts, how they are priced, and various trading strategies such as hedging, speculating, and arbitrage. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales and trading, or other areas of finance with the fundamental knowledge of fixed income. Unlike stock trading or investing in mutual funds or etfs, commodity trading offers tremendous. Then we will explore how commodities are traded in the derivatives markets using futures and options. Under the open outcry method, traders communicate trading. This course provides a comprehensive overview of commodities. This fixed income fundamentals course is perfect for anyone who wants to build up their understanding of capital markets. Open outcry trading takes place as follows: Lastly, spread trading in commodities allows sophisticated investors to take advantage of mispricing opportunities for near riskless profits so understanding them is essential to a. It is designed to equip anyone who desires to begin a career in investment banking, sales, trading, treasury, or other areas of finance that require an. There are several indirect ways to invest in hard vs soft commodities. Commodities trading also allows for market participants to invest and speculate on commodity prices, while providing diversification beyond traditional securities. The ncdex provides enhanced market transparency and empowers farmers to make better business decisions. Sales and trading professionals on a trading floor use the “open outcry” method of trading. It’s a different game, but a game worth learning for investors.Forex And Commodity Trading Masterclass Online Course

Commodity Trading Full Course For Beginners Commodity Trading Explain

Commodity Trading Courses Commodity Options Trading Course (ebook

7 Best Commodity Trading Courses Online in 2024 Empire Capital

Forex commodity trading course basic to pro demo class YouTube

Our Commodity Courses — COMMODITY TRADING CLUB

Commodity Trading Course

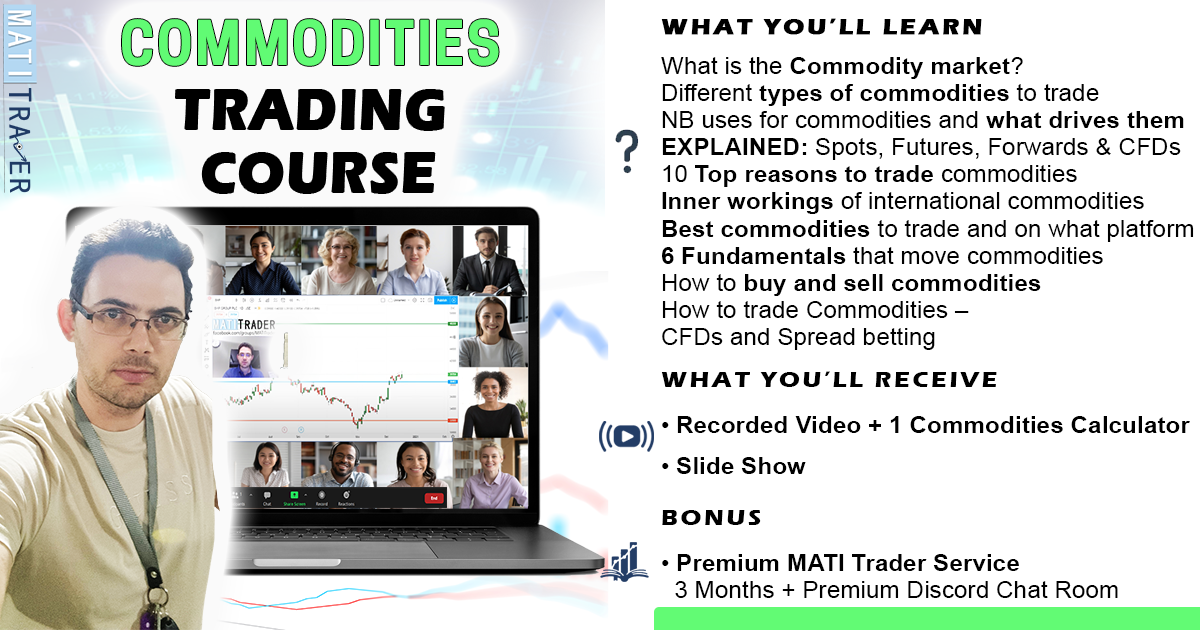

MATI Trader Commodities Trading Course MATI Trader

7 Best Commodity Trading Courses Online in 2024 Trade Brains

MATI Trader Commodities Trading Course MATI Trader

You Will Have The Opportunity To Work Through Practice Examples And Learn How To Identify Key Information On Refinitiv Workspace.

This Introductory Commodities Course Is Perfect For Students Interested In Commodities Derivatives And Trading Strategies.

Trading Commodities Is Different From Trading Stocks.

We Will Introduce The Key Features Of Commodities And Go Over The Major Commodity Categories With Their Key Drivers.

Related Post:

.png?format=1500w)

.png)