Debt Restructuring Courses

Debt Restructuring Courses - Debt freedombbb a+ accreditedfree consultationzero upfront fees You will get an basic exposure to. Certified distressed debt & restructuring professional; Students will learn to understand the importance of financial literacy, identify important personal financial goals, and develop financial planning skills to achieve goals such as college. In this lesson, you will learn all about debt and how it affects corporate restructuring. The course will draw upon lessons learned from previous credit crises to determine sustainable levels of debt, the strengths and weaknesses of deal structures, and how best to respond to. The course will begin with a review of the basics of corporate distress: Online enrollmentflexible termspay less each monthreduce monthly payments Analyzing the existing debt structures to understand what can cause a problem. Connect with top brandsread customer reviews100% free consultation He served as associate dean of. These courses will give you comprehensive insights into intricate restructuring strategies. The attendees will learn the restructuring. You will discover the different aspects of debt, such as par value, coupon rates, prime and libor. He currently teaches classes in antitrust, network industries and secured transactions. He also regularly teaches bankruptcy and corporate reorganizations. Connect with top brandsread customer reviews100% free consultation The corporate debt restructuring course by rcademy will highlight the important concepts required to practice and be considered in any corporate debt restructuring plan. A better life beyond debt begins here. Sessions delve deep into advanced techniques and methodologies essential for navigating. The corporate debt restructuring course by rcademy will highlight the important concepts required to practice and be considered in any corporate debt restructuring plan. He served as associate dean of. This course, presented by the monetary and capital markets department, provides a comprehensive overview of conceptual and operational issues related to the restructuring and. You will get an basic exposure. Analyzing the existing debt structures to understand what can cause a problem. Connect with a counselor, today! How firms get into financial trouble, warning signs, balance sheet composition and risk, and cost of both debt and equity. Students will learn to understand the importance of financial literacy, identify important personal financial goals, and develop financial planning skills to achieve goals. Sessions delve deep into advanced techniques and methodologies essential for navigating. Analyzing the existing debt structures to understand what can cause a problem. He currently teaches classes in antitrust, network industries and secured transactions. The course will draw upon lessons learned from previous credit crises to determine sustainable levels of debt, the strengths and weaknesses of deal structures, and how. You will discover the different aspects of debt, such as par value, coupon rates, prime and libor. A better life beyond debt begins here. Students will learn to understand the importance of financial literacy, identify important personal financial goals, and develop financial planning skills to achieve goals such as college. He currently teaches classes in antitrust, network industries and secured. The objective behind distressed debt and restructuring is to increase recovery rates. Up to 10% cash back the course progresses to the practical aspects of measuring the potential gains and losses of restructuring and liquidation. Analyzing the existing debt structures to understand what can cause a problem. Take the first step toward freedom from debt—with expert help, proven tools, and. Sessions delve deep into advanced techniques and methodologies essential for navigating. This course, presented by the monetary and capital markets department, provides a comprehensive overview of conceptual and operational issues related to the restructuring and. Aspiring debt restructuring specialists should weigh the specific focus and requirements of each certification to align them with their career goals and areas of interest,. You will get an basic exposure to. Expansive info resourcesfinancial analysis toolsbetter, faster decisions The objective behind distressed debt and restructuring is to increase recovery rates. Up to 10% cash back the course progresses to the practical aspects of measuring the potential gains and losses of restructuring and liquidation. In this lesson, you will learn all about debt and how. Online enrollmentflexible termspay less each monthreduce monthly payments Debt freedombbb a+ accreditedfree consultationzero upfront fees He served as associate dean of. Connect with top brandsread customer reviews100% free consultation In this lesson, you will learn all about debt and how it affects corporate restructuring. Certified distressed debt & restructuring professional; The objective behind distressed debt and restructuring is to increase recovery rates. Analyzing the existing debt structures to understand what can cause a problem. Connect with a counselor, today! He currently teaches classes in antitrust, network industries and secured transactions. This course, presented by the monetary and capital markets department, provides a comprehensive overview of conceptual and operational issues related to the restructuring and. You will get an basic exposure to. How firms get into financial trouble, warning signs, balance sheet composition and risk, and cost of both debt and equity. A better life beyond debt begins here. Students will. Up to 10% cash back the course progresses to the practical aspects of measuring the potential gains and losses of restructuring and liquidation. The course will begin with a review of the basics of corporate distress: He also regularly teaches bankruptcy and corporate reorganizations. Analyzing the existing debt structures to understand what can cause a problem. In this lesson, you will learn all about debt and how it affects corporate restructuring. Debt freedombbb a+ accreditedfree consultationzero upfront fees The course will draw upon lessons learned from previous credit crises to determine sustainable levels of debt, the strengths and weaknesses of deal structures, and how best to respond to. The objective behind distressed debt and restructuring is to increase recovery rates. He served as associate dean of. Students will learn to understand the importance of financial literacy, identify important personal financial goals, and develop financial planning skills to achieve goals such as college. Aspiring debt restructuring specialists should weigh the specific focus and requirements of each certification to align them with their career goals and areas of interest, ensuring they choose. You will get an basic exposure to. Expansive info resourcesfinancial analysis toolsbetter, faster decisions Connect with top brandsread customer reviews100% free consultation You will discover the different aspects of debt, such as par value, coupon rates, prime and libor. This course, presented by the monetary and capital markets department, provides a comprehensive overview of conceptual and operational issues related to the restructuring and.Debt Restructuring Definition, Reason, How to Achieve Wall Street Oasis

Online Certificate Course on Corporate Insolvency and Debt

Debt Restructuring Definition, Reason, Achieve

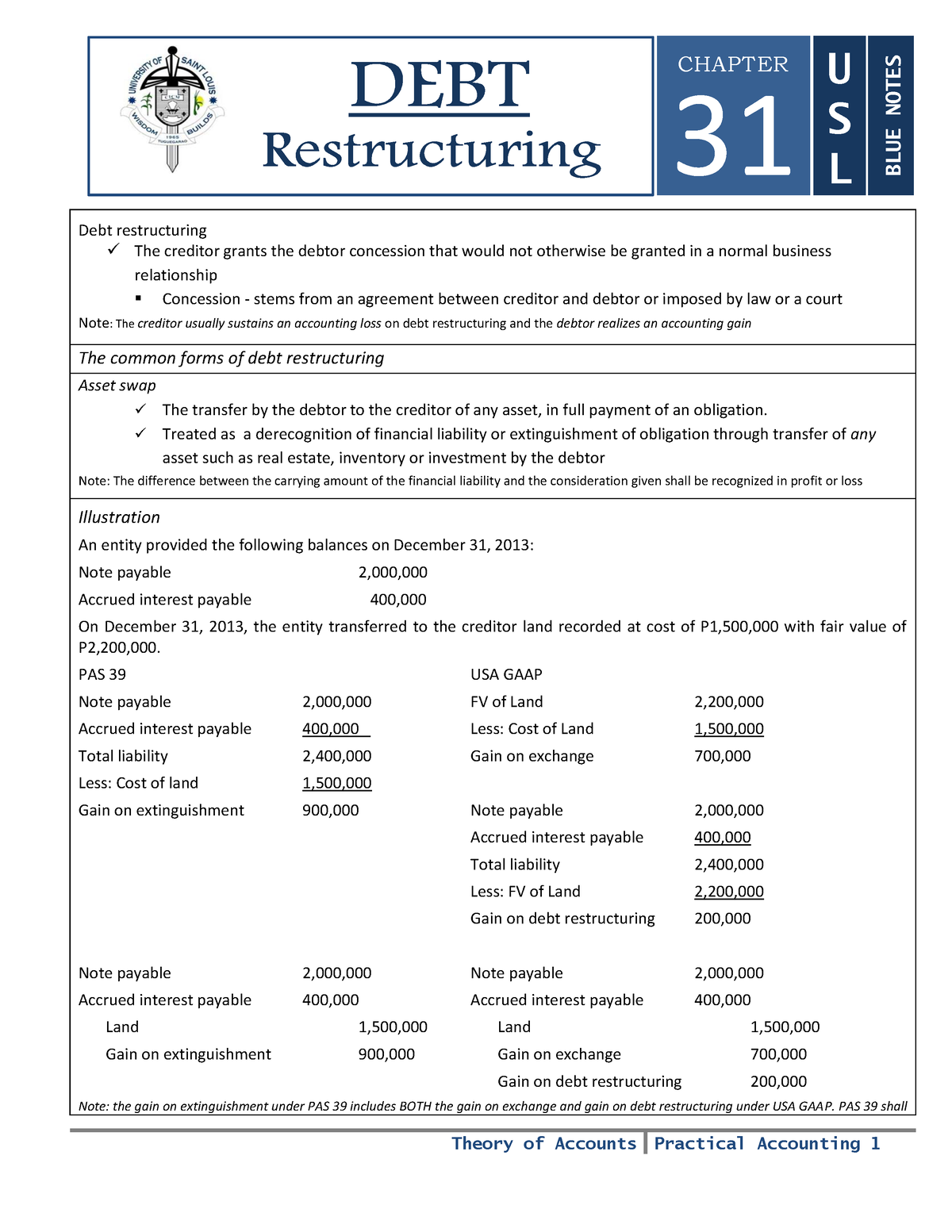

31DebtRestructuring Theory of Accounts Practical Accounting 1 31

What is Debt Restructuring? Types, Benefits & Common Methods

Corporate Debt Restructuring Course YouTube

Debt Restructuring Definition, How It Works, Types & Examples

Debt Restructuring Understanding Debt Restructuring Process & Benefits

Debt Restructuring, Types, Importance, And Process

Debt Restructuring Definition, Reason, How to Achieve Wall Street Oasis

Certified Distressed Debt & Restructuring Professional;

A Better Life Beyond Debt Begins Here.

Take The First Step Toward Freedom From Debt—With Expert Help, Proven Tools, And A Plan Made For You.

These Courses Will Give You Comprehensive Insights Into Intricate Restructuring Strategies.

Related Post:

:max_bytes(150000):strip_icc()/debtrestructuring.asp_final-a64fcb2c01704710bc55061e4304ce7d.png)