Fixed Income Course

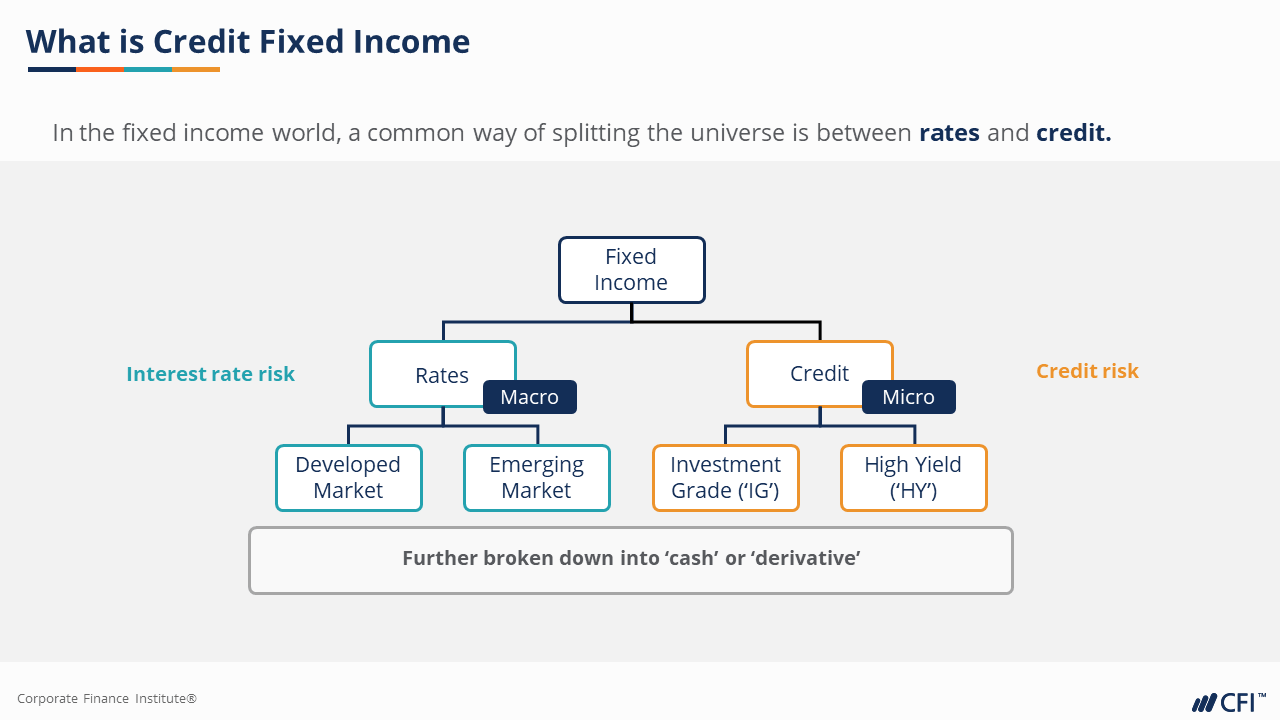

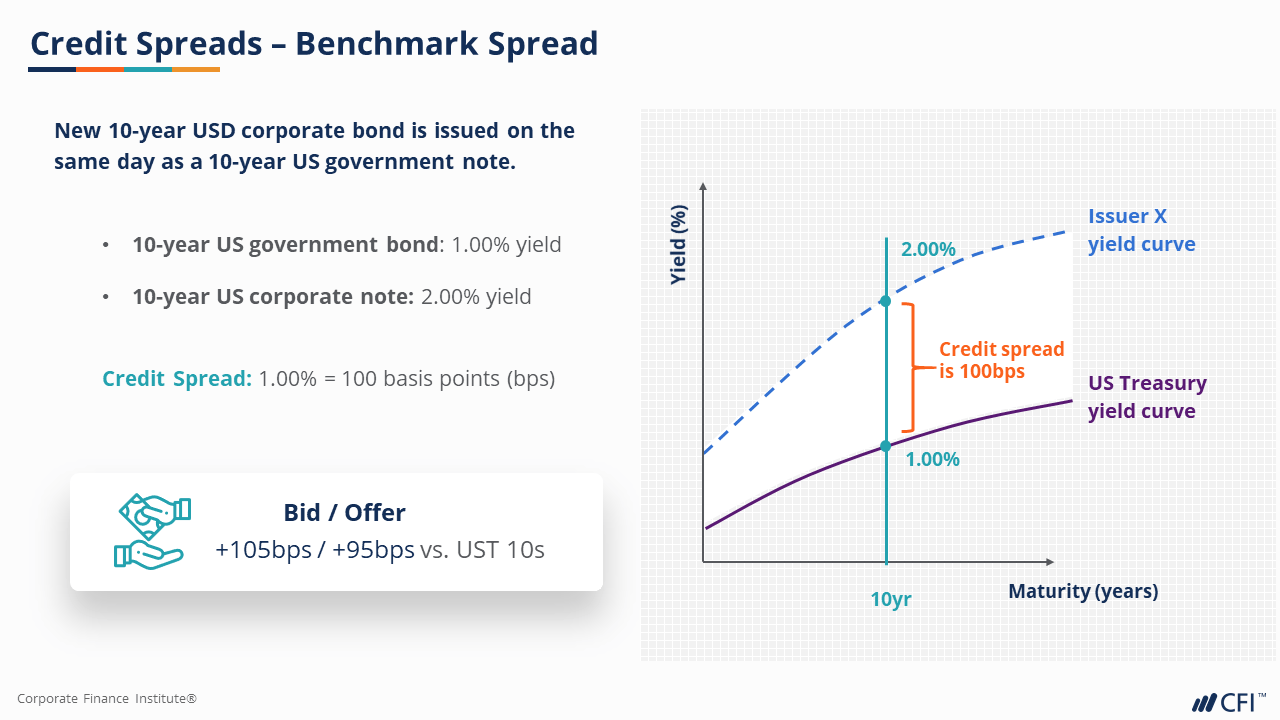

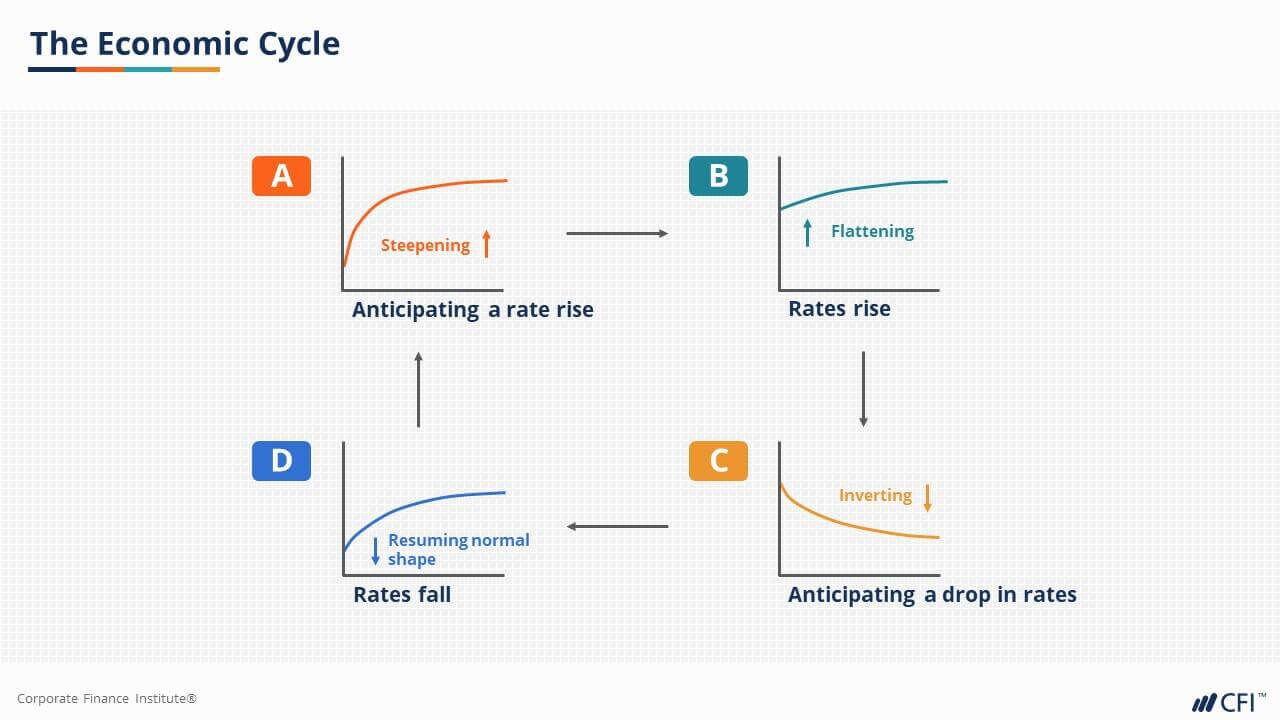

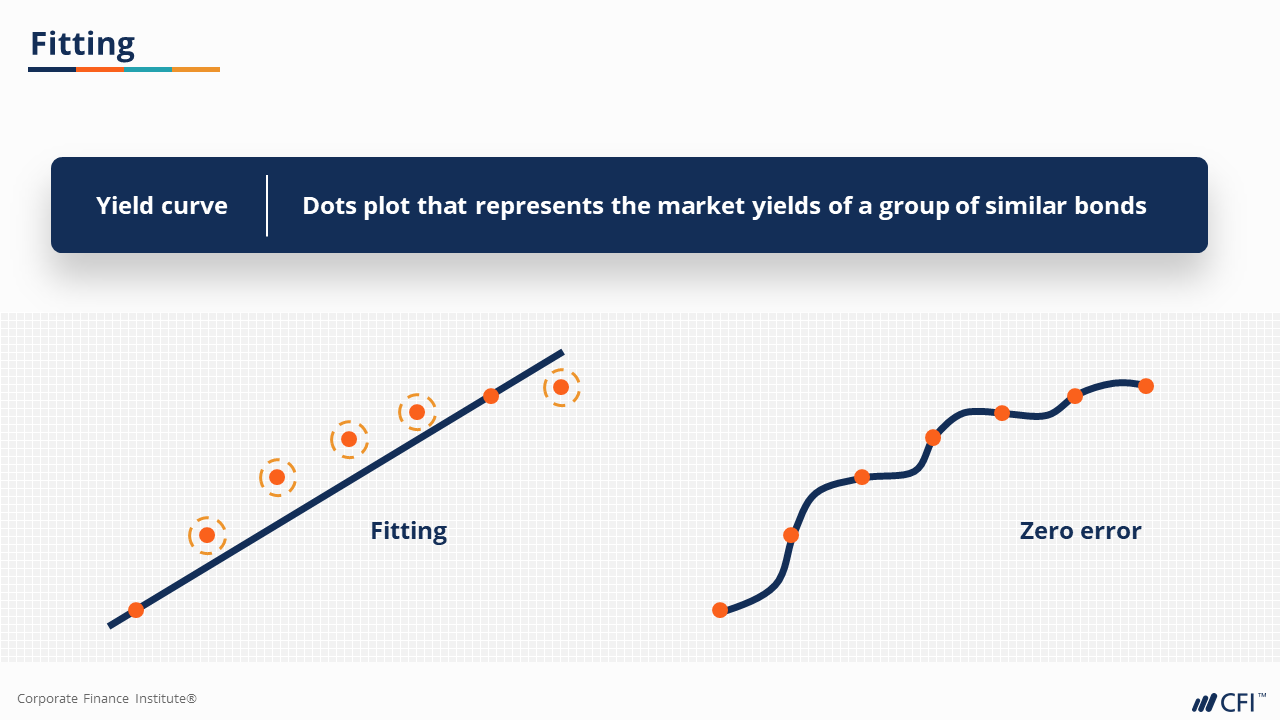

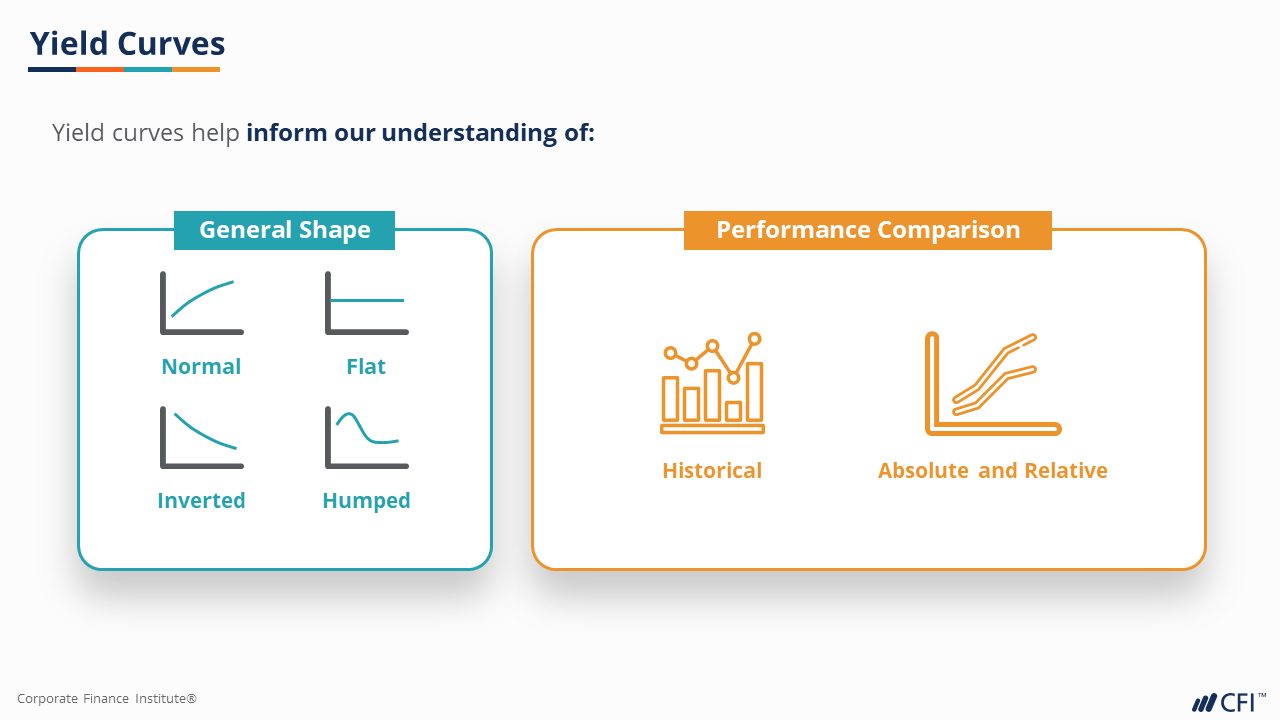

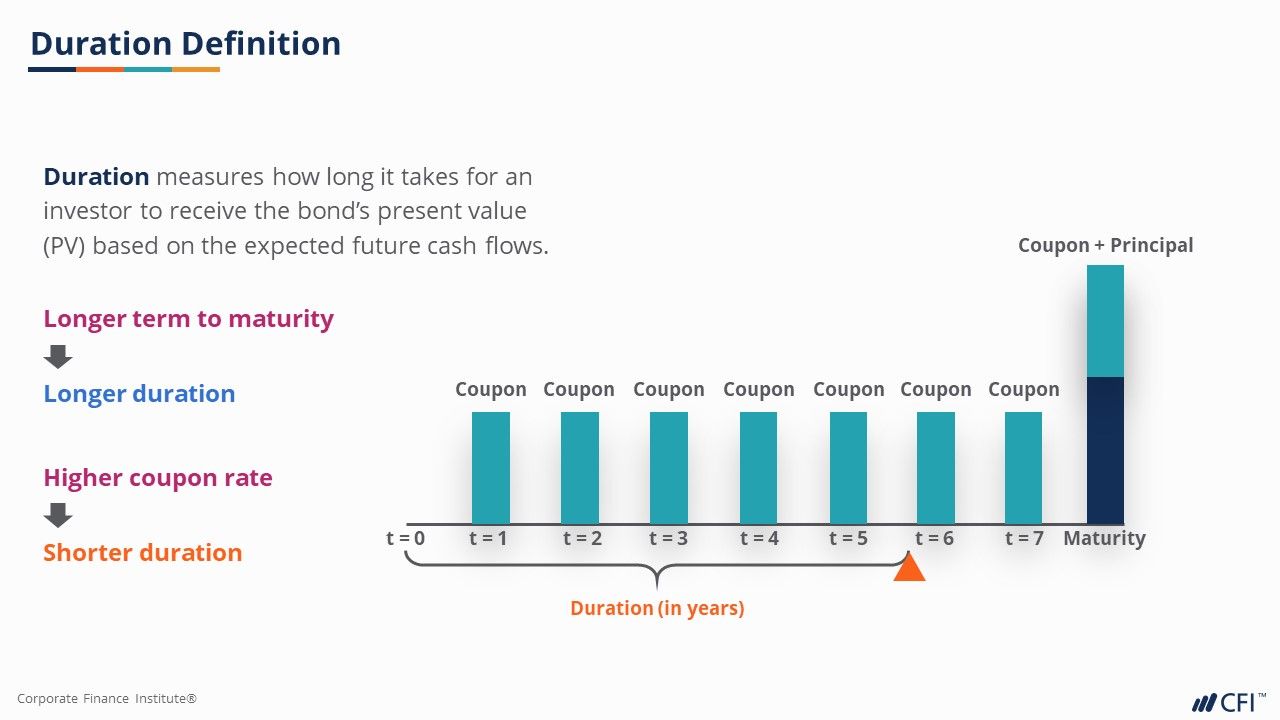

Fixed Income Course - Risk from fixed income transactions is studied along with an overview of yield curve transactions. Fund results and analysisinvestment resourcesdistinctive approach Identify different types of bonds, including government, corporate,. In this fixed income course, you will learn to distinguish between different types of u.s. Whether you’re completely new to capital markets or a seasoned finance professional, fixed income is a. With our best fixed income courses, unleash the potential of fixed income instruments like bonds. And this list of specially selected courses will teach you all that you need to know about them. With its emphasis on developing practical skills for trading, investment and risk management, the training will build upon your existing knowledge of the fixed income markets to give you the skills to compete in the global marketplace. The course may offer 'full course, no certificate' instead. This option lets you see all. In this fixed income fundamentals course, we will explore the basic products and players in fixed income markets. Identify different types of bonds, including government, corporate,. Choose from the industry's most comprehensive selection of fixed income courses for finance professionals, or enroll and jump right into a certification program. Register now and start your journey towards. Embrace this opportunity to refine your investment skills. Tap into the potential of bonds and understand. Risk from fixed income transactions is studied along with an overview of yield curve transactions. Prepare for the future of finance with fixed income courses from cfi. In this fixed income course, you will learn to distinguish between different types of u.s. And this list of specially selected courses will teach you all that you need to know about them. Learn with university partners and peers from around the world. Each type comes with unique characteristics such as interest. Embrace this opportunity to refine your investment skills. The course may offer 'full course, no certificate' instead. Register now and start your journey towards. With our best fixed income courses, unleash the potential of fixed income instruments like bonds. Risk from fixed income transactions is studied along with an overview of yield curve transactions. Tap into the potential of bonds and understand. In this fixed income course, you will learn to distinguish between different types of u.s. Enrolling in a fitch learning course automatically. Fixed income securities, including bonds, treasuries, and notes, serve as the backbone for diversified investment strategies. Monetary policy impacts both the. You can try a free trial instead, or apply for financial aid. Each type comes with unique characteristics such as interest. With our best fixed income courses, unleash the potential of fixed income instruments like bonds. Our repurchase agreement course is. We will introduce key bond features such as par value, coupon, yield curves,. Choose from the industry's most comprehensive selection of fixed income courses for finance professionals, or enroll and jump right into a certification program. With our best fixed income courses, unleash the potential of fixed income instruments like bonds. Fixed income investments offer. Fixed income markets certification (fimc©) from wall street prep. This course is for investors and individuals who show interest in widening. See objectivesdaily navfull overviewfund calculator And this list of specially selected courses will teach you all that you need to know about them. This course sets the foundations of the fixed income markets, providing an overview of how investors. Tap into the potential of bonds and understand. It includes programs, like a fixed income course, credit analysis models, and bond basics. In this fixed income course, you will learn to distinguish between different types of u.s. Monetary policy impacts both the. Fixed income investments offer stability, steady income and lower risk — making them an attractive choice for many. Risk from fixed income transactions is studied along with an overview of yield curve transactions. While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift in sales volumes in 2025, assuming sellers remain pragmatic on. And this list of specially selected courses will teach you all that you need. Tap into the potential of bonds and understand. Each type comes with unique characteristics such as interest. Register now and start your journey towards. The course may not offer an audit option. Whether you’re completely new to capital markets or a seasoned finance professional, fixed income is a. At gfmi, we offer a full suite of fixed income courses including an introduction to fixed income, repurchase agreements, and yield curve analysis. Fixed income markets certification (fimc©) from wall street prep. This option lets you see all. Register now and start your journey towards. The course may not offer an audit option. Prepare for the future of finance with fixed income courses from cfi. This option lets you see all. Each type comes with unique characteristics such as interest. In this fixed income course, you will learn to distinguish between different types of u.s. With its emphasis on developing practical skills for trading, investment and risk management, the training will build upon. You can try a free trial instead, or apply for financial aid. This course is for investors and individuals who show interest in widening. Fixed income securities, including bonds, treasuries, and notes, serve as the backbone for diversified investment strategies. In this fixed income fundamentals course, we will explore the basic products and players in fixed income markets. Fixed income investments offer stability, steady income and lower risk — making them an attractive choice for many investors, especially those nearing retirement or seeking. Choose from the industry's most comprehensive selection of fixed income courses for finance professionals, or enroll and jump right into a certification program. Tap into the potential of bonds and understand. See objectivesdaily navfull overviewfund calculator Our repurchase agreement course is. Each type comes with unique characteristics such as interest. Register now and start your journey towards. Fixed income markets certification (fimc©) from wall street prep. With its emphasis on developing practical skills for trading, investment and risk management, the training will build upon your existing knowledge of the fixed income markets to give you the skills to compete in the global marketplace. Learn with university partners and peers from around the world. Master fixed income & bond valuation like a pro | learn yield, duration & advanced bond strategies | exclusive benefits worth $300+! Prepare for the future of finance with fixed income courses from cfi.Credit Fixed I Finance Course I CFI

Credit Fixed I Finance Course I CFI

Fundamentals of Fixed Course I Finance Course I CFI

Fundamentals of Fixed Course I Finance Course I CFI

Advanced Fixed I Finance Course I CFI

Introduction to the Fixed and Rates Markets Asset Class Ltd

Learn Fixed Corporate Finance Institute

Advanced Fixed I Finance Course I CFI

Fundamentals of Fixed Course I Finance Course I CFI

6 Best Fixed Investments in 2025 • Dumb Little Man

It Includes Programs, Like A Fixed Income Course, Credit Analysis Models, And Bond Basics.

With Our Best Fixed Income Courses, Unleash The Potential Of Fixed Income Instruments Like Bonds.

Embrace This Opportunity To Refine Your Investment Skills.

Our First Lesson In This Course Focused On How Central Banks Use Monetary Policy To Control The Price Of Money Largely Through The Control Of Interest Rates.

Related Post: