Irs Afsp Courses

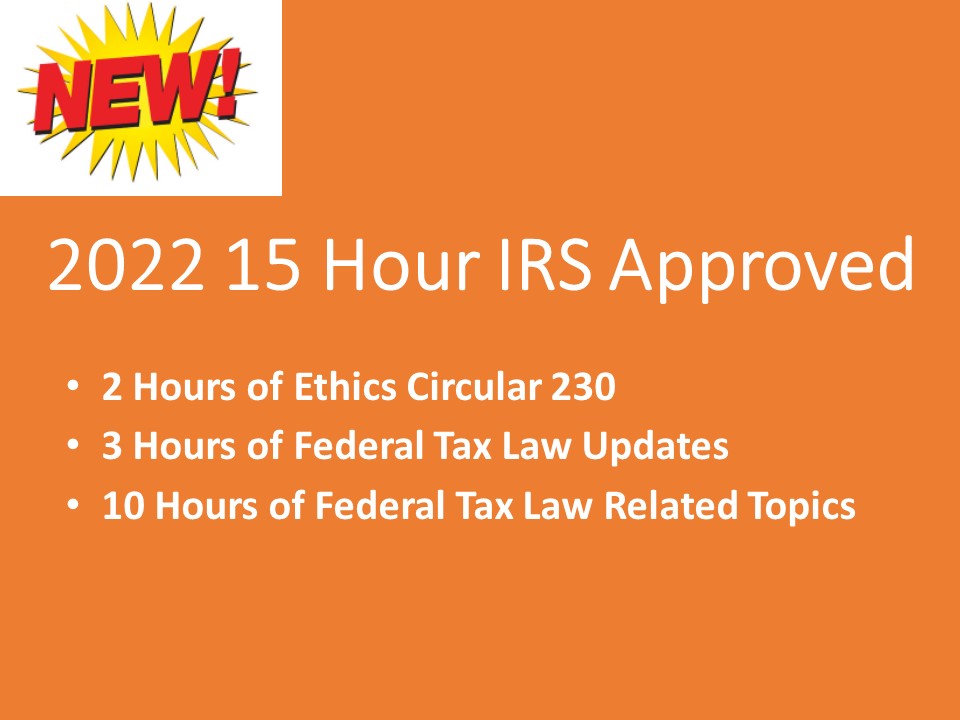

Irs Afsp Courses - The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily increase their tax knowledge and improve their tax. Click here to learn more about how you can be part of the irs annual filing season program (afsp). The afsp tax courses are designed. The annual filing season program is a voluntary program designed to encourage tax return preparers to. If you’re a tax preparer looking to participate in the irs annual filing season program (afsp), one of the key requirements is completing the annual federal tax refresher. What is the annual filing season program? Earn your afsp record of completion with irs approved continuing education. To recognize ptin holders who pursue greater professionalism, the irs established the annual filing season program (afsp). Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Enhance your tax expertise today. Want to become an irs afsp record of completion holder? Our irs approved tax class is for tax preparers who want to take an irs afsp tax preparation course to complete their continuing education requirements. Earn your afsp record of completion with irs approved continuing education. Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. The afsp tax courses are designed. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. The irs annual filing season program is a voluntary program designed to highlight tax preparers who have demonstrated a willingness to improve their tax knowledge and filing competency. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Access to all courses at $199. The annual filing season program. Explore the afsp tax credential, its benefits, eligibility, and how it compares to other tax qualifications. Click here to learn more about how you can be part of the irs annual filing season program (afsp). 2025 tax brackets, thresholds, and inflation adjustments. Earn your afsp record of completion with irs approved continuing education. The irs annual filing season program is. Earn your afsp record of completion with irs approved continuing education. Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. The afsp tax courses are designed. The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily increase their tax knowledge and improve their tax.. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Irs afsp (annual filing season program) tax courses are a series of continuing education courses offered by the internal revenue service (irs). To recognize ptin holders who pursue greater professionalism, the irs established the annual filing season program (afsp). What is. The afsp tax courses are designed. Enhance your tax expertise today. The annual filing season program. The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily increase their tax knowledge and improve their tax. What is the annual filing season program? Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Access to all courses at $199. If you’re a tax preparer looking to participate in the irs annual filing season program (afsp), one of the key requirements is completing the annual federal tax refresher. The afsp tax courses are designed. Click. If you’re a tax preparer looking to participate in the irs annual filing season program (afsp), one of the key requirements is completing the annual federal tax refresher. Want to become an irs afsp record of completion holder? The afsp tax courses are designed. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at. Access to all courses at $199. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. 2025 tax brackets, thresholds, and inflation adjustments. The afsp tax courses are designed. If you’re a tax preparer looking to participate in the irs annual filing season program (afsp), one of the key requirements is. If you’re a tax preparer looking to participate in the irs annual filing season program (afsp), one of the key requirements is completing the annual federal tax refresher. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Earn your afsp record of completion with irs approved continuing education. Enhance your. Earn your afsp record of completion with irs approved continuing education. Click here to learn more about how you can be part of the irs annual filing season program (afsp). The annual filing season program is a voluntary program designed to encourage tax return preparers to. Find tax classes at tax practitioner institutes in your state and receive continuing education. Explore the afsp tax credential, its benefits, eligibility, and how it compares to other tax qualifications. What is the annual filing season program? The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily increase their tax knowledge and improve their tax. The annual filing season program is a voluntary program. The annual filing season program is a voluntary program designed to encourage tax return preparers to. Our irs approved tax class is for tax preparers who want to take an irs afsp tax preparation course to complete their continuing education requirements. Want to become an irs afsp record of completion holder? If you’re a tax preparer looking to participate in the irs annual filing season program (afsp), one of the key requirements is completing the annual federal tax refresher. The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily increase their tax knowledge and improve their tax. The irs annual filing season program is a voluntary program designed to highlight tax preparers who have demonstrated a willingness to improve their tax knowledge and filing competency. 2025 tax brackets, thresholds, and inflation adjustments. What is the annual filing season program? To recognize ptin holders who pursue greater professionalism, the irs established the annual filing season program (afsp). Earn your afsp record of completion with irs approved continuing education. Click here to learn more about how you can be part of the irs annual filing season program (afsp). Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. The afsp tax courses are designed. Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. Explore the afsp tax credential, its benefits, eligibility, and how it compares to other tax qualifications. Access to all courses at $199.Programa de Certificación IRS/AFSP Centro Latino de Capacitacion

IRS Approved Continuing Education AFSP

Ultimate AFSP IRS Guide & Approved AFSP Courses [2021] Accounting

AFSP IRS Approved Continuing Education AFSP

IRS AFSP Program Exam + Classes Ameritax Online

IRS Annual Federal Tax Refresher Course AFTR Training

IRS AFSP(Tax Courses)

Annual Federal Tax Refresher Course (AFTRC) + Classes 2024 Ameritax

Ultimate AFSP IRS Guide & Approved AFSP Courses [2021]

5 reasons to earn the AFSP Record of Completion Surgent CPE

Find Tax Classes At Tax Practitioner Institutes In Your State And Receive Continuing Education Credits At A Reasonable Cost.

Enhance Your Tax Expertise Today.

Irs Afsp (Annual Filing Season Program) Tax Courses Are A Series Of Continuing Education Courses Offered By The Internal Revenue Service (Irs).

The Annual Filing Season Program.

Related Post:

![Ultimate AFSP IRS Guide & Approved AFSP Courses [2021] Accounting](https://i.pinimg.com/originals/51/81/47/518147979ce7331e5a805205a2fb38f8.png)

![Ultimate AFSP IRS Guide & Approved AFSP Courses [2021]](https://ipassthecpaexam.com/wp-content/uploads/2020/08/ipassthecpaexam.com1_.png)