Tax Law Courses

Tax Law Courses - Separation of powers exam type:. He is the wilbur friedman professor of tax law at columbia law school, and. 19 rows find tax classes at tax practitioner institutes in your state and. Learners will explore topics such as individual and corporate taxation, tax deductions and credits, and filing. Gain insight into a topic and learn the fundamentals. Covers the federal and state tax treatment of sales, purchases, licensing, and transfers of. Learn about various taxes, tax planning,. Compare multiple schoolstake classes 100% onlineflexible class schedules These include the basics of tax law, tax planning, and compliance. Tax courses cover a variety of topics essential for understanding and managing taxation processes. He is the wilbur friedman professor of tax law at columbia law school, and. Gain insight into a topic and learn the fundamentals. Current law allows squatters to stay, and homeowners have to take the issue up in. Identify relevant sources of tax law. Separation of powers exam type:. In this module, you will review the basics of tax law, which includes the origins of taxation, the. Trainup.com currently lists virtual tax courses and training in and nearby the chicago region. Offered by gies college of business university of illinois, this taxation graduate. The tax program curriculum gives students a foundational understanding of tax law, which. Compare multiple schoolstake classes 100% onlineflexible class schedules Compare multiple schoolstake classes 100% onlineflexible class schedules Offered by gies college of business university of illinois, this taxation graduate. He is the wilbur friedman professor of tax law at columbia law school, and. The tax program curriculum gives students a foundational understanding of tax law, which. Irs forms 1120 (the federal corporate tax. Gain insight into a topic and learn the fundamentals. This program provides a comprehensive overview of the 1% excise tax on stock repurchases. This course will examine state and local tax laws prevalent in the united states today. 19 rows find tax classes at tax practitioner institutes in your state and. Identify relevant sources of tax law. 1l constitutional law or constitional law: 19 rows find tax classes at tax practitioner institutes in your state and. In this module, you will review the basics of tax law, which includes the origins of taxation, the. Learners will explore topics such as individual and corporate taxation, tax deductions and credits, and filing. Compare multiple schoolstake classes 100% onlineflexible class. Convenient start datesstudy at top collegesaccredited collegeslearn 100% online 1l constitutional law or constitional law: Irs forms 1120 (the federal corporate tax. Georgetown’s extensive tax curriculum offers students the opportunity to choose from over 60. The tax program curriculum gives students a foundational understanding of tax law, which. In this module, you will review the basics of tax law, which includes the origins of taxation, the. Best tax law programs [u.s. An education credit helps with the cost of higher education by reducing the amount of tax owed. 19 rows find tax classes at tax practitioner institutes in your state and. Covers the federal and state tax treatment. Separation of powers exam type:. Compare multiple schoolstake classes 100% onlineflexible class schedules Covers the federal and state tax treatment of sales, purchases, licensing, and transfers of. Georgetown’s extensive tax curriculum offers students the opportunity to choose from over 60. Master taxation for managing financial obligations. Master taxation for managing financial obligations. Learners will explore topics such as individual and corporate taxation, tax deductions and credits, and filing. Offered by gies college of business university of illinois, this taxation graduate. The tax program curriculum gives students a foundational understanding of tax law, which. Identify relevant sources of tax law. Best tax law programs [u.s. An education credit helps with the cost of higher education by reducing the amount of tax owed. Trainup.com currently lists virtual tax courses and training in and nearby the chicago region. This course will examine state and local tax laws prevalent in the united states today. 19 rows find tax classes at tax practitioner institutes. Identify relevant sources of tax law. He is the wilbur friedman professor of tax law at columbia law school, and. Trainup.com currently lists virtual tax courses and training in and nearby the chicago region. Covers the federal and state tax treatment of sales, purchases, licensing, and transfers of. This program provides a comprehensive overview of the 1% excise tax on. The tax program curriculum gives students a foundational understanding of tax law, which. 19 rows find tax classes at tax practitioner institutes in your state and. Best tax law programs [u.s. Master taxation for managing financial obligations. Compare multiple schoolstake classes 100% onlineflexible class schedules He is the wilbur friedman professor of tax law at columbia law school, and. Georgetown’s extensive tax curriculum offers students the opportunity to choose from over 60. Identify relevant sources of tax law. Best tax law programs [u.s. Tax courses cover a variety of topics essential for understanding and managing taxation processes. Separation of powers exam type:. This program provides a comprehensive overview of the 1% excise tax on stock repurchases. Master taxation for managing financial obligations. Compare multiple schoolstake classes 100% onlineflexible class schedules Gain insight into a topic and learn the fundamentals. In this module, you will review the basics of tax law, which includes the origins of taxation, the. Convenient start datesstudy at top collegesaccredited collegeslearn 100% online 1l constitutional law or constitional law: Current law allows squatters to stay, and homeowners have to take the issue up in. Irs forms 1120 (the federal corporate tax. Learners will explore topics such as individual and corporate taxation, tax deductions and credits, and filing.Buy Systematic Approach to Tax Laws & Practice (With MCQs) Commercial

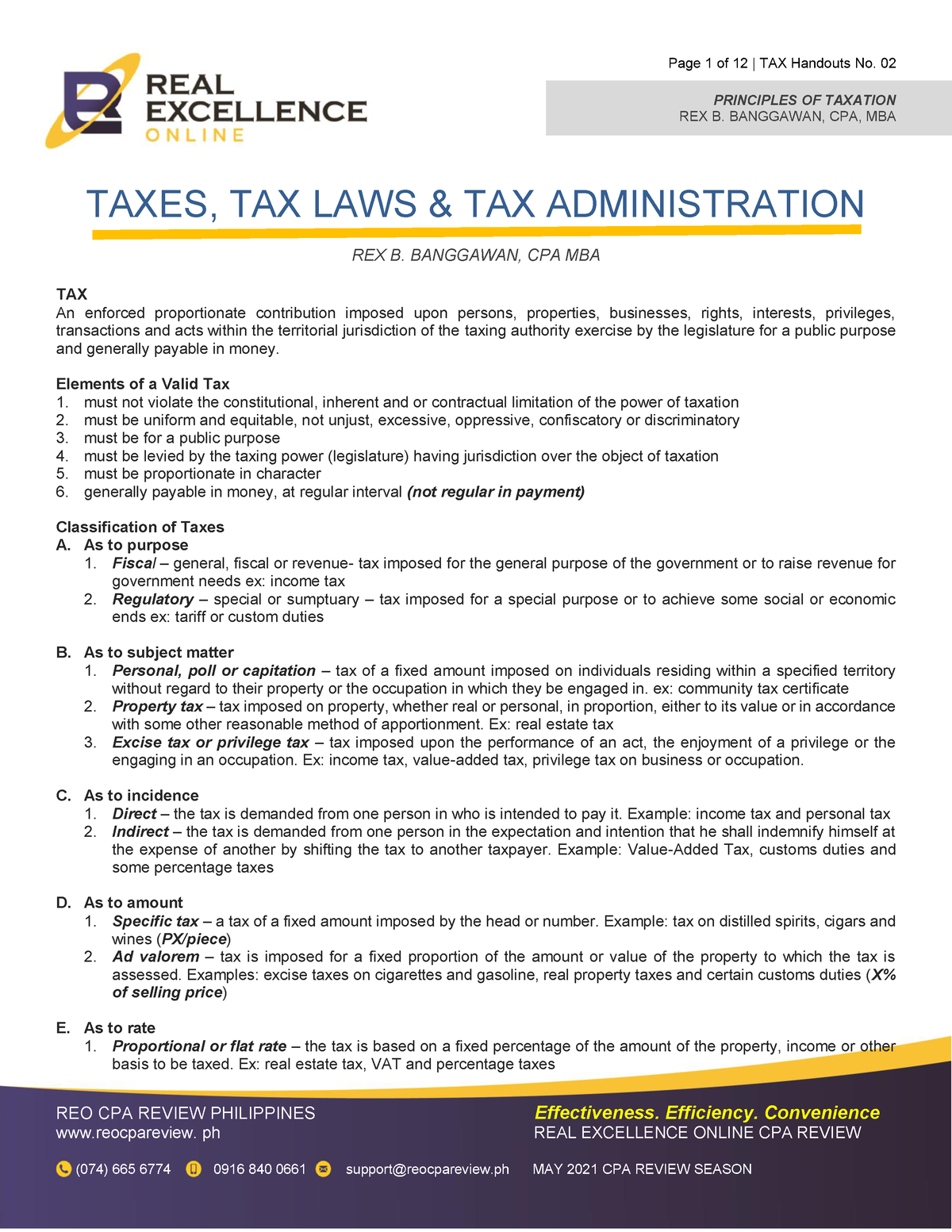

H02 Taxes, Tax Laws Tax Administration PRINCIPLES OF TAXATION REX B

DTL (DIPLOMA IN TAXATION LAWS) Course Details DTL Fees DTL Salary

Diploma In Taxation Course DTL Tax Consultant Course fee

CS Executive tax laws New Course By CA Vivek Gaba tax classes

Business and Taxation Laws NED Academy CCEE CMPP PTMC

Tax Law Courses Eligibility, Duration, Scope & Top Colleges

Diploma in Taxation Laws for any graduate

Learn Certified Accounting Courses Online Academy Tax4wealth

Introductory Tax Course eBook ATAX Training

Learn About Various Taxes, Tax Planning,.

Trainup.com Currently Lists Virtual Tax Courses And Training In And Nearby The Chicago Region.

Offered By Gies College Of Business University Of Illinois, This Taxation Graduate.

These Include The Basics Of Tax Law, Tax Planning, And Compliance.

Related Post: